Stock Control Methods Explained: FIFO, LIFO, WAC, JIT, and ABC (2025)

Running a business means knowing what’s in stock, what’s selling, and what needs to be reordered. Without a solid system in place, it’s easy to overbuy, run out of key items, or tie up money in inventory you don’t need.

In this guide, we’ll walk you through common stock control methods like FIFO, LIFO, WAC, JIT, ABC — and help you figure out which one matches your business.

What Is a Stock Control Method?

A stock control method is a way to track how and when inventory moves in and out of your business. It helps you decide what to order, how much to keep on hand, and how to value the goods you sell. This approach helps you:

• Reduce spoilage and shrinkage

• Optimize cash flow

• Improve demand forecasting

These methods aren’t just for large companies. Even small teams benefit from having a consistent way to handle stock—especially when margins are tight or supply chains shift quickly.

Tracking by Hand vs. Using Software

Some businesses still use spreadsheets or paper to track stock. But when you’re dealing with frequent orders or expiration dates, it’s easy to make mistakes.

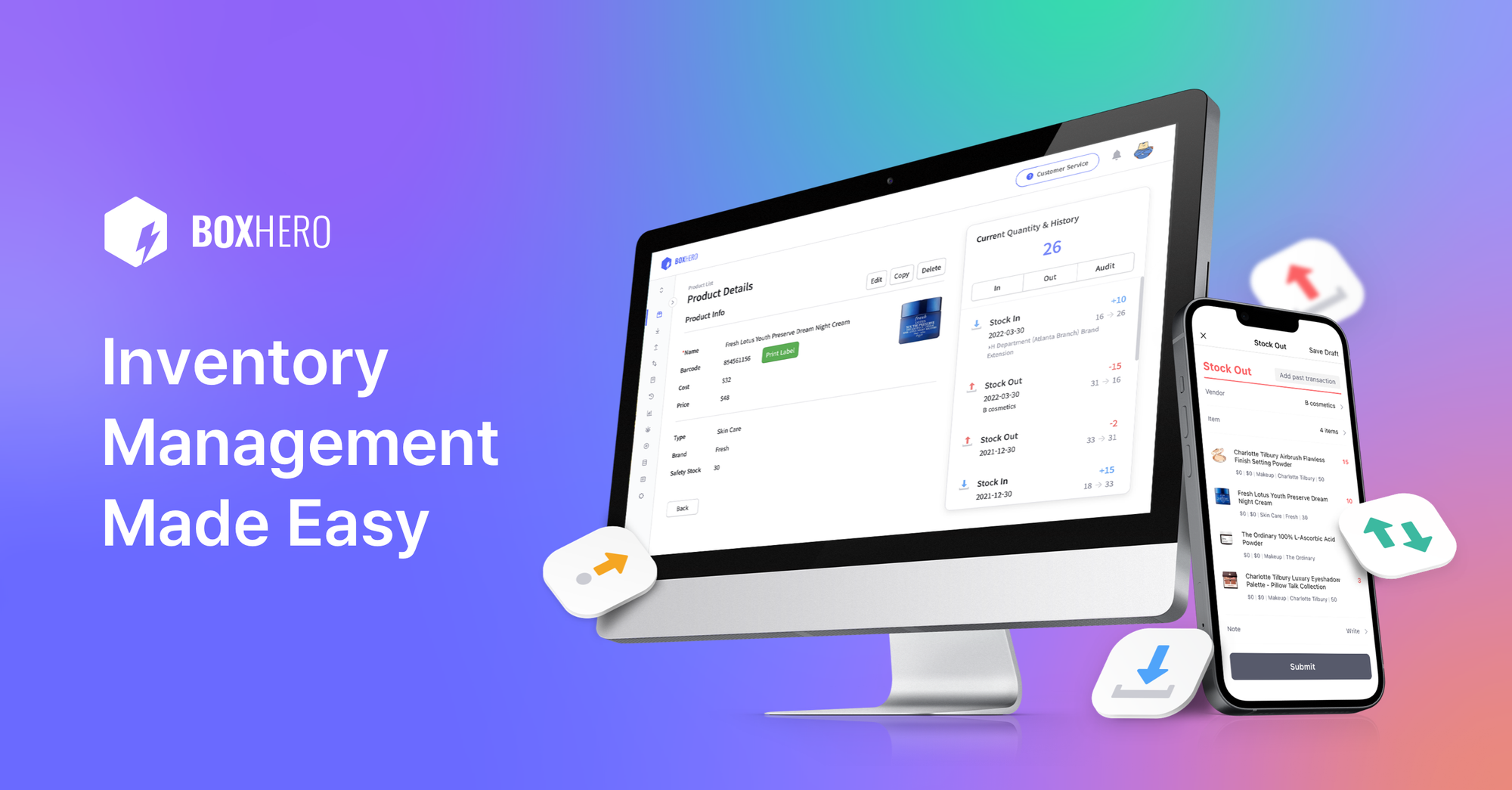

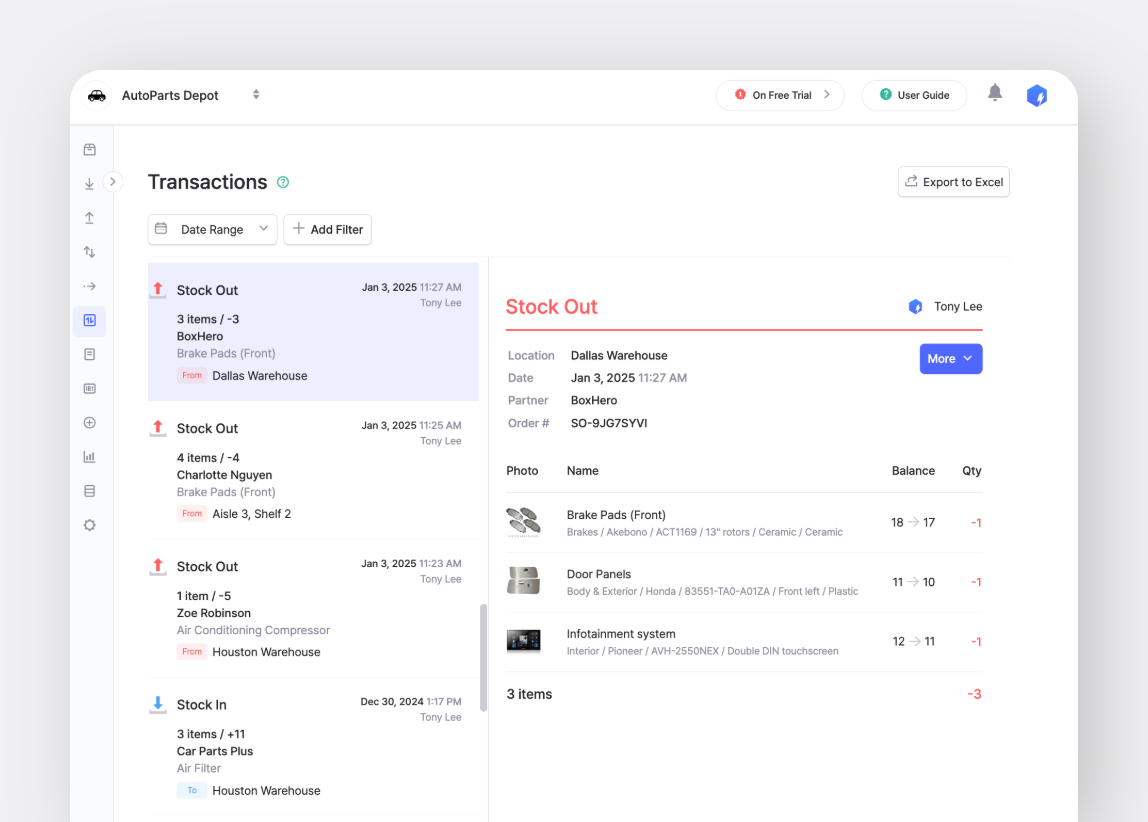

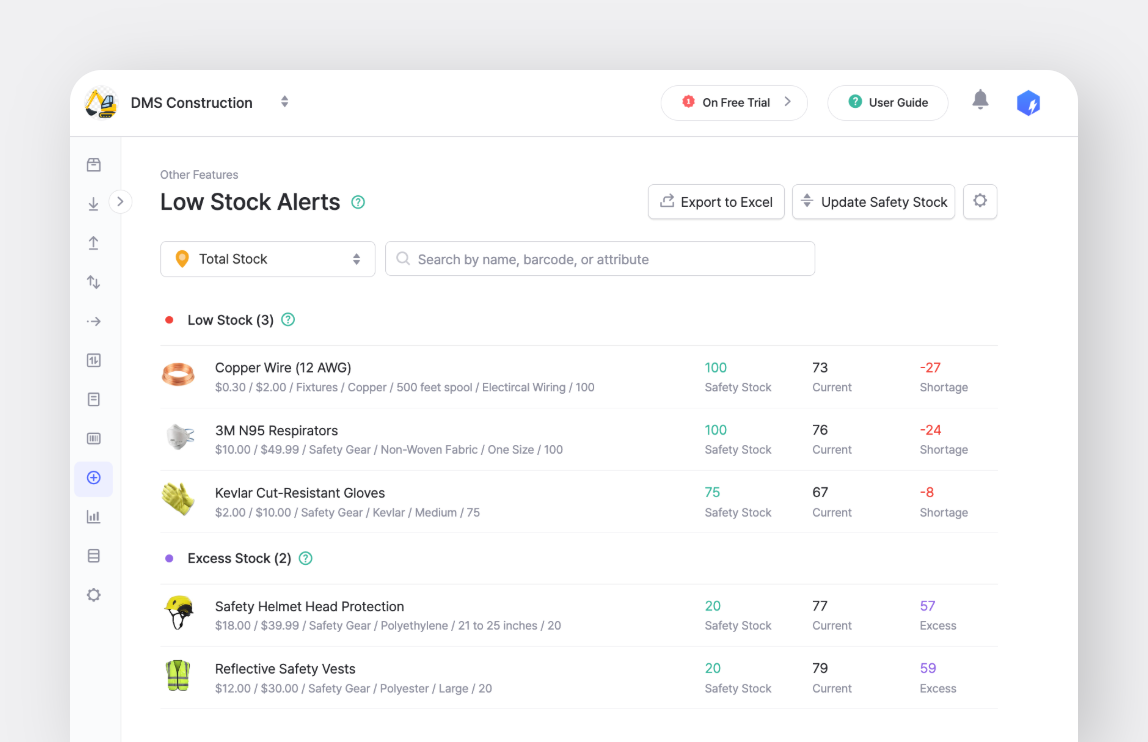

Nowadays, BoxHero and other inventory management solutions can handle things like barcode scanning, stock alerts, and simple cost tracking, without needing a full warehouse system.

These tools make inventory control easier, help reduce mistakes, and give you insights so you can make better decisions. Once you’ve got the basics covered, you can choose a method that fits how your team works.

FIFO: First-In, First-Out

Most of us have once found expired food in the back of our fridge. That's a classic example of what happens when we don’t use FIFO. In inventory management, FIFO (First-In, First-Out) means the oldest stock gets sold or used first, just like rotating milk or bread at home.

This is the most common method for businesses with perishable goods. It prevents items from sitting too long, helps reduce waste (and keep products fresh), and matches what most of us already do: clearing out older items first.

FIFO works well for:

• Restaurants

• Pharmacies

• Brands selling skincare, supplements, or anything with a short shelf life

Example:

You sell a product for $500 that originally cost $300 to stock. Let's say restocking now costs $700. FIFO still records the older $300, so your profit looks like $200 ($500 – $300) even though margins are shrinking in real life. This means your actual margin is negative $200.

Watch Out For:

- FIFO shows higher profits during inflation (older, cheaper stock), which may lead to higher taxes.

- Profit figures may appear stronger than reality.

Still, if freshness and efficiency are top priorities, FIFO is one of the most reliable and widely accepted inventory control methods globally.

LIFO: Last-In, First-Out

LIFO flips the script: the most recently stocked items are sold or used first.

Picture a pile of bricks at a construction site. You stack the newest ones on top, and that’s exactly where you grab from when it’s time to build. No one is digging underneath for last week’s batch. This is LIFO (Last-In, First-Out) at play.

Unlike FIFO, LIFO doesn’t care about age or freshness. It's not about tomatoes or milk, but strategy, especially when it comes to finances.

Works well for:

• Raw goods like metals or chemicals

• Bulk products that don’t expire

Example:

Let’s say you buy T-shirts at $300 in June, $400 in July, and sell one for $500.

FIFO records the older $300 cost → $200 profit

LIFO records the newer $400 cost → $100 profit

That difference can lower your reported earnings (i.e. taxable profit).

Why Would Anyone Use LIFO?

In industries where products don’t expire, LIFO can make a lot of sense. But the real power play? Taxes.

During inflation, the cost of restocking goes up. When prices are rising, LIFO lets you report the higher costs first. That means lower profits on paper, which often leads to a lower tax bill.

Sneaky smart? Maybe.

Legal? Yes, but not everywhere.

Is LIFO Always a Good Idea?

Not really. While LIFO can offer short-term tax benefits, it comes with some serious limitations, especially for businesses that operate internationally and are concerned about financial optics.

- Companies Are Choosing Optics Over Tax Cuts

Even in the U.S., where LIFO is permitted under GAAP, not every business sticks with it. During the inflation hikes of 2021–2022, around many U.S. companies switched from LIFO to FIFO. This is because while LIFO helped reduce taxable income, FIFO showed higher profits on paper, a key metric investors and analysts pay attention to. It’s a reminder that inventory methods aren’t just accounting choices, but strategic tools that influence how healthy your business looks from the outside.

- LIFO Is Prohibited Under IFRS

LIFO is not allowed under International Financial Reporting Standards (IFRS), which are used in most countries including Canada, the EU, and the UK. According to The CPA Journal (2025), LIFO has been prohibited under IFRS since 2003, limiting its use on a global scale.

Weighted Average Cost (WAC)

Weighted Average Cost (WAC) simplifies inventory valuation by averaging the cost of all your stock. It's meant to handle price fluctuations and removes the need to track each item’s individual cost.

Example:

If you spend $170,000 on 300 units:

WAC = $170,000 ÷ 300 = $566.67 per unit

Each item sold is recorded at $566.67, regardless of the original cost.

When to Use WAC:

WAC is accepted worldwide under IFRS and GAAP. It's great for dealing with interchangeable items or prices that change frequently.

If you’re already operating your business internationally, WAC is probably the smartest choice. It smooths out the price swings that come with FIFO and LIFO by averaging costs, making your reporting cleaner and forecasting simpler.

Best for:

• Teams that want simple, consistent reporting

• Global operations needing IFRS compliance

JIT (Just-in-Time)

Let’s take it to the kitchen. Imagine you’re ready to cook, but when you open the fridge, it’s full of wilting vegetables and stale bread. Disappointing, right? That’s what Just-in-Time (JIT) inventory aims to avoid: having only what you need, exactly when you need it — not in advance.

In inventory management, JIT means keeping inventory levels as low as possible, and ordering supplies only when they’re needed for production or sales. It’s an inventory optimization strategy designed to cut costs and reduce waste.

Best for:

• Businesses with limited storage

• Teams with reliable suppliers

How Does JIT Work?

Think of it like a finely choreographed dance:

- Your supplier knows exactly when to send parts or materials.

- Your factory or store has minimal stock on hand.

- As soon as you use one part, the next one arrives almost like clockwork.

This level of coordination requires clear communication, reliable suppliers, and real-time inventory tracking. That’s where tools like BoxHero come in, giving you an instant visibility into stock levels, reorder points, and supply movement.

Many businesses use the Reorder Point (ROP) formula to help automate just-in-time restocking.

Example:

If it takes 5 days for new stock to arrive and you sell 50 units per day:

ROP = 5 × 50 = 250 units

So when your stock hits 250, it’s time to reorder — no sooner, no later.

JIT thrives on these smart triggers to keep inventory lean and efficient. It cuts down storage costs, minimizes waste, and speeds up inventory turnover.

But like any system, it’s not without its risks, when the unexpected happens. Let’s take a look at the potential downsides.

Risks of JIT:

Just-in-Time (JIT) inventory’s biggest advantage, which is keeping minimal stock levels, is also what makes it risky.

Let's say you apply the JIT method to run your business and everything seems to be going smoothly... until it isn’t. A sudden disruption like a supplier delay, transport strike, or even a natural disaster hits, and you have no buffer stock. This can bring your operations to a standstill: production stalls, shelves go empty, and customer orders go unfulfilled.

That is exactly what happened during the Global COVID-19 Supply Chain Crisis. Automakers around the world were forced to halt assembly lines, not because of a lack of demand, but due to a shortage of critical computer chips. Their JIT systems, designed for maximum efficiency, offered no cushion for disruption.

As reported in Supply Chain Connect, JIT-dependent manufacturers were “crippled by a shortage of computer chips, which are vital car components… forced to halt assembly lines."

So, while JIT helps reduce inventory costs, it demands near-perfect supplier reliability and solid contingency plans.

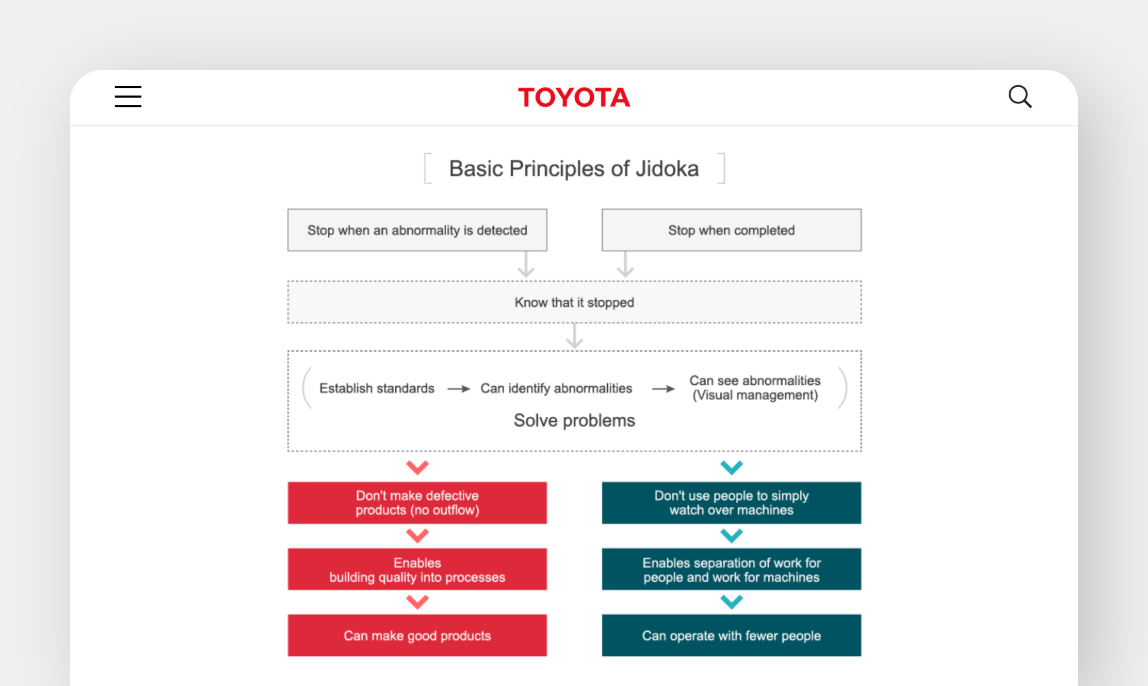

Toyota: A Real-World JIT Success

While Toyota is a global car giant today, that wasn’t always the case. After WWII, it was a small company with limited space, cash, and materials. To survive, Toyota created the Just-in-Time (JIT) system, getting parts only when needed, as needed.

The results were hard to ignore. This system helped Toyota lower inventory costs, speed up production, improve quality, and build a leaner supply chain.

Today, this approach is known as the Toyota Production System (TPS), and it's widely regarded as a global benchmark for operation.

▶︎ Why It Worked for Toyota:

- Lower Inventory Costs – Minimal stock meant less money tied up in storage.

- Less Waste – No overproduction or excess materials sitting idle.

- Better Quality – Real-time feedback led to faster issue detection.

- Faster Turnaround – Shorter lead times improved responsiveness.

ABC Analysis

Businesses could be selling all kinds of products, but not all of them bring in the same value or move at the same speed.

In inventory management, ABC analysis (also called ABC classification) is a stock control method that ranks items by importance. You can focus on what matters most, instead of spending equal time on low-value items that don’t move the needle.

With ABC, items are divided into three categories:

- Category A: Smallest in quantity but high in value; consists of the most important items

- Category B: This is slightly larger in terms of volumes of SKUs and will usually be made up of products of less value

- Category C: Typically the largest category where products will contribute the least to your business’s bottom line

💡 The idea?

Spend more time and energy managing your A-items closely, automate or streamline how you handle C-items, and find a balance for the B-items.

Why use ABC?

- Helps you prioritize stock checks and reorder planning

- Makes it easier to avoid overstocking slow sellers

- Often used alongside FIFO or WAC

According to the Journal of Business Logistics (2022), companies that implement ABC inventory analysis combined with real-time tracking tools report up to 15% reduction in excess stock and improved SKU-level visibility.

Works well for:

• Brands managing hundreds of SKUs

• Figuring out which items deserve your attention, and which ones can run on autopilot

How to Implement ABC in 3 Steps

▶︎ Step 1. Calculate Annual Consumption Value

Use this formula to determine the value each item brings in:

Annual Consumption Value = Unit Cost × Units Sold per Year

▶︎ Step 2. Sort and Categorize Products

Once you have the values, sort all items from highest to lowest:

- A-items: Top 10–20% of items that are 70–80% of your inventory value

- B-items: The next 20–30% that make up around 15–25% of value

- C-items: The remaining 50–70% of items that are 5–10% of the total value

▶︎ Step 3. Apply Control Strategies by Category

- A: Monitor closely; no room for stockouts

- B: Check regularly

- C: Keep it simple—bulk or automate restocks

More Inventory Control Methods to Know

Inventory management isn’t one-size-fits-all. Depending on your product type or business model, you might need a more tailored method. Here are a few worth knowing:

FEFO (First Expired, First Out)

FEFO prioritizes products by expiration date, not arrival date, so older (soon-to-expire) items go out first.

Best For: Pharma, food, skincare and anything with an expiry.

EOQ (Economic Order Quantity)

EOQ helps you figure out the most cost-efficient amount to order balancing ordering costs and storage costs.

Quick Breakdown:

Where:

D = Annual demand

S = Ordering cost

H = Holding cost per unit

Best For: Businesses with steady demand and predictable supply.

Kanban / Two-Bin System

A simple, visual method: one bin empties → you reorder → second bin keeps things running.

Best For: Manufacturing, workshops, or businesses with repeat processes.

Conclusion

Inventory control isn’t about following the trend. The best stock control method depends on what you sell, how often prices change, and how you manage your supply chain.

If you’re in food or health, FIFO is hard to beat. If you’re dealing with bulk materials and based in the U.S., LIFO might make sense. For everyone else, WAC or ABC are practical, low-maintenance options.

| Method | Use Case | Notes |

|---|---|---|

| FIFO | Expiring goods, fast turnover | Simple and widely accepted |

| LIFO | U.S.-based goods with rising costs | Not allowed under IFRS |

| WAC | Uniform stock with fluctuating costs | Smooths out pricing differences |

| JIT | Low-inventory operations | Needs dependable suppliers |

| ABC | Prioritizing high-value items | Used for planning, not accounting |

You don’t need a massive system to get started. Tools like BoxHero support barcode scanning, low stock alerts, and basic reporting — making it easier to stay organized without extra steps.