How to Navigate the 2024 Inflation as a Small Business Owner

The NFIB Small Business Economic Trends report tells us that 22% of small business owners see inflation as their top worry, a clear sign of its deep impact on business operations.

Luckily, savvy inventory management strategies like Just-In-Time (JIT) and regular stock checks can help soften the blow by keeping stock levels optimal and cutting unnecessary costs.

In this guide, we'll learn how you can use advanced inventory techniques, forge stronger relationships with suppliers, and use technology to boost your cash flow, slash your expenses, and stay competitive.

Decoding Inflation: What It Really Means for Small Businesses

Inflation, in simple terms, is the general increase in prices and fall in the purchasing value of money over time. For small business owners, this translates into a two-pronged problem:

- Rising costs of raw materials, goods, and services

- Diminishing purchasing power of potential customers

2024 Economic Backdrop: The Ripple Effects of Inflation on Small Business Operations

Inflation doesn't just raise prices—it magnifies existing challenges that small business owners face every day. Understanding these amplified difficulties is key to developing strategies that mitigate their impact.

NFIB Chief Economist Bill Dunkelberg said,

“The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy. But for 29 consecutive months, small business owners have expressed historically low optimism and their views about future business conditions are at the worst levels seen in 50 years. Small business owners need relief as inflation has not eased much on Main Street.”

A. Increased Costs and Pricing Dilemmas

Inflation keeps biting, and it's a tough spot for small businesses trying to manage costs and set the right prices. According to the NFIB, about 25% of owners have had to raise their prices just to keep up, which matches findings from the Xero report—nearly half the small businesses out there are bumping up prices to keep their cash flow healthy.

However, raising prices isn't a simple solution. It can lead to decreased demand, especially as consumers' purchasing power diminishes. Small business owners find themselves in a tight spot, having to balance their need to cover costs with the risk of losing customers.

B. Cash Flow Challenges

Cash flow is getting tighter, a big worry for small businesses. Xero points out that 40% of these businesses are wrestling with choppy cash flow, and what’s more, 29% don’t have any cash stashed away for rainy days.

This paints a pretty clear picture: small businesses are really feeling the pinch from inflation. Without enough cash in reserve, it’s tough to handle unexpected costs or jump on opportunities that need some upfront investment.

C. Sales and Revenue Impact

Inflation’s reach stretches right into sales and revenue too. The latest from NFIB shows a dip, with a net 14% of businesses seeing a slump in nominal sales recently, and expectations for real sales revenue aren't looking up either, with a slight drop to a net negative 13%.

This tells us that as prices climb, customers might start holding back on spending, which hits small businesses right where it hurts—their bottom line.

D. Operational Challenges

Inflation creates various operational challenges for small businesses:

- Inventory Management: With costs climbing, it’s pricier to keep shelves stocked. Businesses have to strike a balance between having enough inventory and not getting weighed down by the costs of keeping it.

- Supplier Relationships: As suppliers face their own cost increases, they may pass these on to small businesses. This can lead to tough conversations and the need to renegotiate terms just to keep things running smoothly.

- Labor Market Pressures: Inflationary periods often coincide with wage pressures, adding another layer of complexity for small business owners.

E. Personal Well-being of Business Owners

The impact of inflation extends beyond business operations to affect the personal lives of business owners. According to Xero, a whopping 58% of small business owners say cash flow problems have taken a toll on their well-being, leading to:

- Stress (84%)

- Anxiety (79%)

- Sleepless nights (64%)

And it doesn’t stop there—42% find they’re missing out on precious family and friend time because of these financial strains. These numbers highlight the harsh reality of what it’s like to run a small business under economic pressure.

Why Effective Inventory Management Is More Critical Now Than Ever

In the face of these multifaceted challenges, effective inventory management emerges as a crucial strategy for small businesses to combat inflation. Proper inventory control can help address many of the issues we've discussed:

- It can mitigate cash flow problems by optimizing stock levels and reducing tied-up capital.

- It can help businesses respond more nimbly to price changes and supply chain disruptions.

- It can improve operational efficiency, potentially offsetting some inflationary pressures.

Interestingly, despite these benefits, the Xero report points out that a staggering 89% of small businesses don’t use cash flow forecasting tools—a missed opportunity for many to tighten up their financial strategies, including better inventory control.

Changing Inventory Management Practices to Adapt to Inflationary Pressures

As a small business owner, you're likely finding that inflation is pushing you to rethink your traditional inventory management approaches. Here's an overview of how you and your peers are adapting:

- Leaner inventory practices: Moving towards keeping less stock on hand to reduce carrying costs and free up capital.

- Supplier reassessment: Exploring new supplier relationships and renegotiating terms with existing ones to manage costs.

- Product mix adjustments: Reevaluating product offerings to focus on more profitable or cost-effective items.

- Increased technology adoption: Turning to more sophisticated inventory management tools to optimize stock levels and improve efficiency.

- More frequent price reviews: Adjusting pricing strategies more often to reflect changing costs and market conditions.

- Enhanced focus on inventory turnover: Pay closer attention to how quickly stock moves to minimize the impact of rising carrying costs.

- Strategic bulk purchasing: Selectively buying in larger quantities when advantageous to lock in lower prices.

- Adam B., Division Manager at Heartland Payment Systems

Inventory Strategies to Combat Inflation

Let’s have a detailed look at inventory management strategies you can adopt to curb the inflationary pressure.

A. Optimize Inventory Levels

In times of inflation, optimizing inventory levels becomes crucial for maintaining profitability and cash flow. Two key approaches to consider are Just-In-Time (JIT) inventory management and Economic Order Quantity (EOQ).

Just-In-Time (JIT) Inventory Management

JIT is an inventory strategy that involves receiving goods only as they are needed in the production process, reducing inventory holding costs.

Key components of JIT:

- Demand-pull system: Production based on actual customer orders rather than forecasts

- Continuous flow: Minimizing work-in-process inventory

- Takt time: Aligning production pace with customer demand rate

Case study: Toyota's JIT Approach:

Toyota's JIT system, known as the Toyota Production System (TPS), has been a benchmark for efficient inventory management. The core principle is to have the right parts, at the right time, in the right amount. This approach helps Toyota maintain lean operations and reduce the impact of rising inventory costs.

Benefits in inflationary periods:

- Lowers the amount of capital tied up in inventory

- Minimizes storage costs

- Allows for quicker adaptation to price changes

- Reduces the risk of inventory obsolescence

Economic Order Quantity (EOQ)

EOQ is a measure that determines the optimal quantity of inventory in order to minimize total inventory costs. It aims to find the most cost-effective quantity of stock to order, considering factors such as demand rate, ordering costs, and holding costs.

How to calculate EOQ:

EOQ = √[(2 × D × S) ÷ H]

Where:

- D = Annual demand quantity

- S = Fixed cost per order

- H = Annual holding cost per unit

Applying EOQ during inflation:

- Regularly update cost parameters to reflect inflationary changes

- Consider price breaks or quantity discounts when calculating EOQ

- Factor in potential price increases when determining order quantities.

B. Manage Supplier Relationships

In an inflationary environment, strong supplier relationships become even more crucial. Here's how you can do this.

1. Building Strong Relationships with Existing Suppliers

Long-term relationships can lead to negotiations for better prices, quality, and delivery conditions, which are vital when external costs are rising.

Moreover, strong relationships might also provide more flexibility in supply terms, such as the ability to order smaller quantities more frequently without significant price penalties.

Key Strategies:

- Open communication: Regularly discuss market conditions and potential price changes

- Collaborative planning: Share forecasts and work together on inventory management

- Performance metrics: Establish and monitor KPIs for supplier performance

2. Have a Diversified Supplier Base

Diversifying your supplier base can help mitigate risks associated with inflation and supply chain disruptions. Benefits include:

- Increased bargaining power

- Reduced dependency on a single source

- Access to competitive pricing

- Enhanced supply chain resilience

3. Negotiating Favorable Terms During Inflationary Periods

Proactive negotiation strategies can help offset some of the impacts of inflation. You can adopt following techniques:

- Volume commitments: Offer to purchase larger quantities in exchange for price stability

- Extended contracts: Negotiate longer-term agreements to lock in prices

- Payment terms: Explore options like early payment discounts

- Value-added services: Request additional services (e.g., vendor-managed inventory) to offset price increases

C. Conduct Regular Inventory Counts

Regular inventory counts become even more critical during inflationary periods. Accurate inventory records are crucial for:

- Maintaining optimal stock levels

- Preventing stockouts and overstocking

- Accurate financial reporting

- Efficient order fulfillment

How to Conduct an Inventory Count

a) Cycle counting:

This method involves counting a subset of inventory on a regular basis, such as daily or weekly, which helps maintain accuracy without disrupting operations.

- Count a portion of inventory regularly (e.g., daily or weekly)

- Focus on high-value or fast-moving items more frequently

b) Full physical inventory:

A thorough approach where every item in inventory is counted, typically conducted annually to ensure complete inventory accuracy.

- Conduct a complete count at least annually

- Consider timing (e.g., during slow periods) to minimize operational disruption

c) ABC analysis:

This technique segments inventory into three categories (A, B, and C) based on value and turnover rate to prioritize counting efforts and resources.

- Categorize inventory based on value and turnover

- Adjust counting frequency accordingly to focus on more critical items

Using Technology for Inventory Counts

You can do this manually, but the process is time-consuming and prone to human error. Modern inventory management systems can significantly improve the efficiency and accuracy of inventory counts.

Key features to look for:

- Barcode or RFID scanning

- Real-time updating

- Integration with point-of-sale systems

- Analytics and reporting capabilities

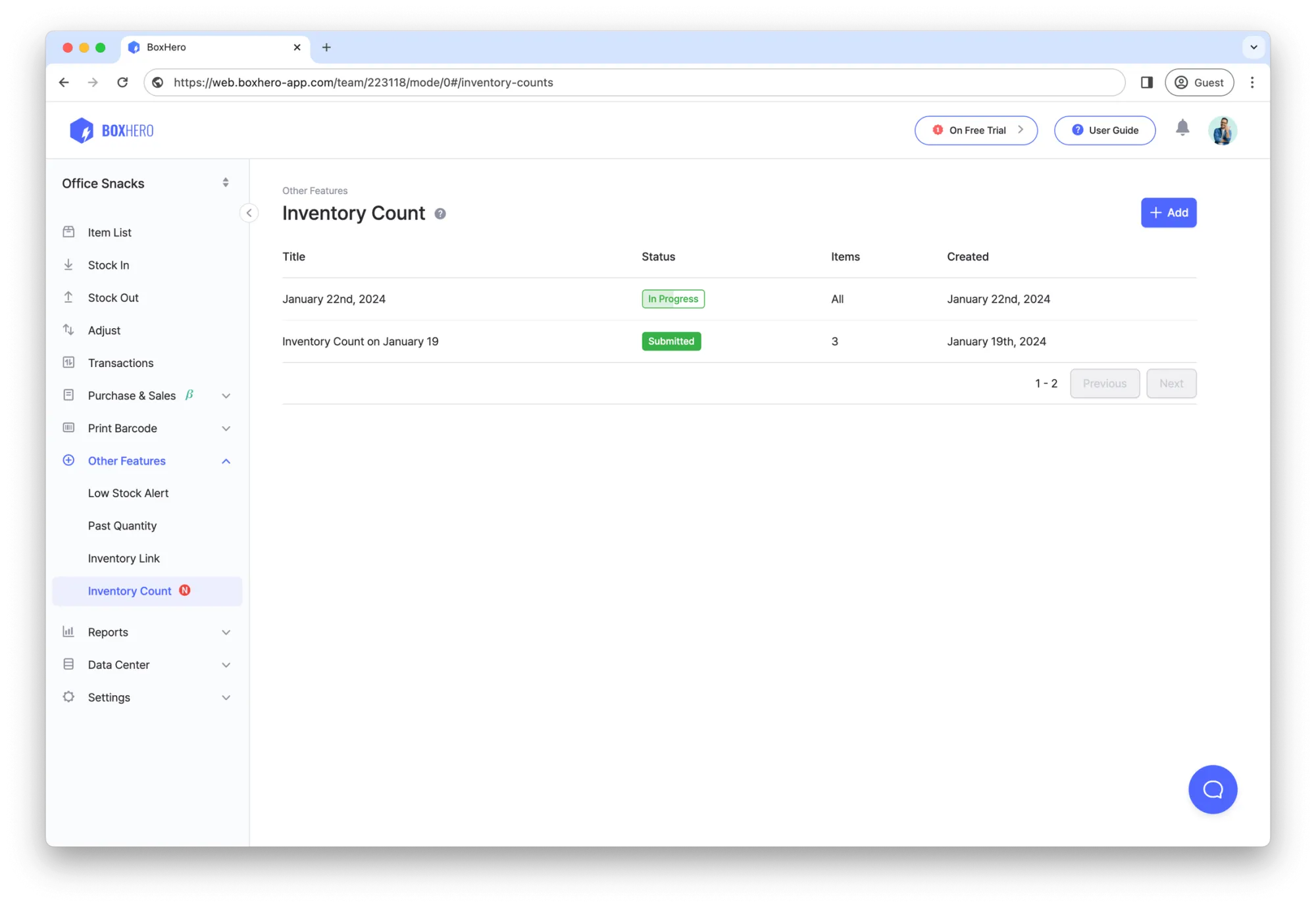

You can conduct efficient inventory counts using BoxHero by following these steps:

- Prepare for count: Organize and label all inventory items for easy access.

- Access inventory count feature: Log into BoxHero, navigate to the 'Inventory Count' under the 'Other Features' in the left bar.

- Set up the count: Initiate a new count session, selecting specific products or categories.

- Utilize barcode scanning: Employ barcode scanning for accurate and fast item counting.

- Review discrepancies: Automatically compare counted quantities against system records and adjust as necessary.

- Finalize the count: Complete the count, allowing BoxHero to update inventory levels accordingly.

- Analyze results: Use BoxHero’s tools to analyze and address inventory trends and discrepancies.

D. Use Technology for Inventory Management

Advanced software solutions can help you optimize inventory levels, reduce costs, and improve decision-making.

Inventory management software is a tool that enables businesses to monitor, track, and handle their inventory levels, orders, sales, and deliveries efficiently. It includes elements such as real-time inventory tracking, barcode scanning, automated reorder alerts, and data analytics.

Key Advantages:

- Real-time inventory tracking

- Automated reordering

- Demand forecasting

- Multi-location management

- Reporting and analytics

How BoxHero Supports Small Businesses During Inflation

BoxHero offers several features that help you minimize the pinch of inflationary pressure. These include barcode scamming, real-time tracking, multi-user access, data analytics, and mobile accessibility. Here’s how it helps:

- Cost management: BoxHero's tools streamline inventory tracking and analysis, preventing both overstocking and understocking. This precision in inventory management frees up capital and minimizes the risk of inventory shortages.

- Supplier coordination: With real-time data and trend analysis, you can better coordinate with suppliers to manage delivery schedules, negotiate better terms, and respond quickly to supply chain disruptions. This is particularly crucial when suppliers also face inflationary challenges.

- Enhanced operational efficiency: By automating the more labor-intensive aspects of inventory management, BoxHero reduces the time and effort needed to manage stock. This efficiency allows businesses to focus on strategic decisions rather than getting bogged down in daily operational tasks.

BoxHero offers customization options to fit the unique needs of different businesses, whether they operate in retail, manufacturing, or any sector that requires efficient inventory management.

Additionally, as your business grows or as market conditions change, BoxHero's flexible platform can scale to meet increasing demands, making it a long-term solution for businesses looking to manage inventory more effectively.

Thrive Amidst Inflation With Strategic Inventory Management

In times of inflation, waiting to react can really hit your profits hard and make you miss out on opportunities. Instead, proactive strategies help you keep your head above water and can set you up for success despite economic hurdles.

By optimizing inventory levels with JIT and EOQ techniques, strengthening supplier relationships, and leveraging technology, you can maintain competitiveness and protect your bottom line.

In the face of inflationary pressures, investing in robust inventory management solutions like BoxHero can provide significant returns. It simplifies tracking and managing your inventory and supports your business’s ability to adapt to changing economic conditions efficiently.